The Debt Pipeline: Canada Is Drowning In Debt

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”— The Sun Also Rises, Ernest Hemingway, 1926

For those outside Calgary, the rupture of the major water-carrying pipe is a local annoyance, divorced from their lives. The fact that it now appears it will take 3-5 weeks to restore normal water delivery in the city— original estimates from the mayor said 3-5 days— is tough luck for inhabitants of Canada’s energy city.

Even that estimate is being treated skeptically by a public who were manipulated and abused by the political structure during the recent Covid years. Testing shows that this same pipe— it’s large enough to drive a car through— has five more “hot spots” that could lead to further trouble. In short, repairing and maintaining the infrastructure in Calgary is going to be a huge investment. Married to the city’s debt crisis, a new transit line and the need for other infrastructure projects it’s daunting.

But it’s not a localized problem. Toronto’s new crosstown subway project is years over budget even as the city punts on repairing/ replacing its vital Gardiner Expressway. Montreal’s bridges are a construction meltdown. Vancouver, Edmonton, Halifax— name the city. They’re all faced with crushing repairs while looking down the barrel of the debt gun.

How bad is the debt bomb? The voice on the other end of the line was grave. This retired financial executive says Canada is effectively bankrupt. He’s seen this coming after his almost 50 years in the Canadian industry. A decade of profligate government spending, Canada’s massive debts and electing activist politicians have brought Canada to a nasty place.

The weak spot in Canada’s wall is government debt, he says, and when the inflection point arrives it will happen in a hurry. As Mike Campbell said in The Sun Also Rises about what brought on his bankruptcy, “Friends. I had a lot of friends. False friends. Then I had creditors, too. Probably had more creditors than anybody in England.”

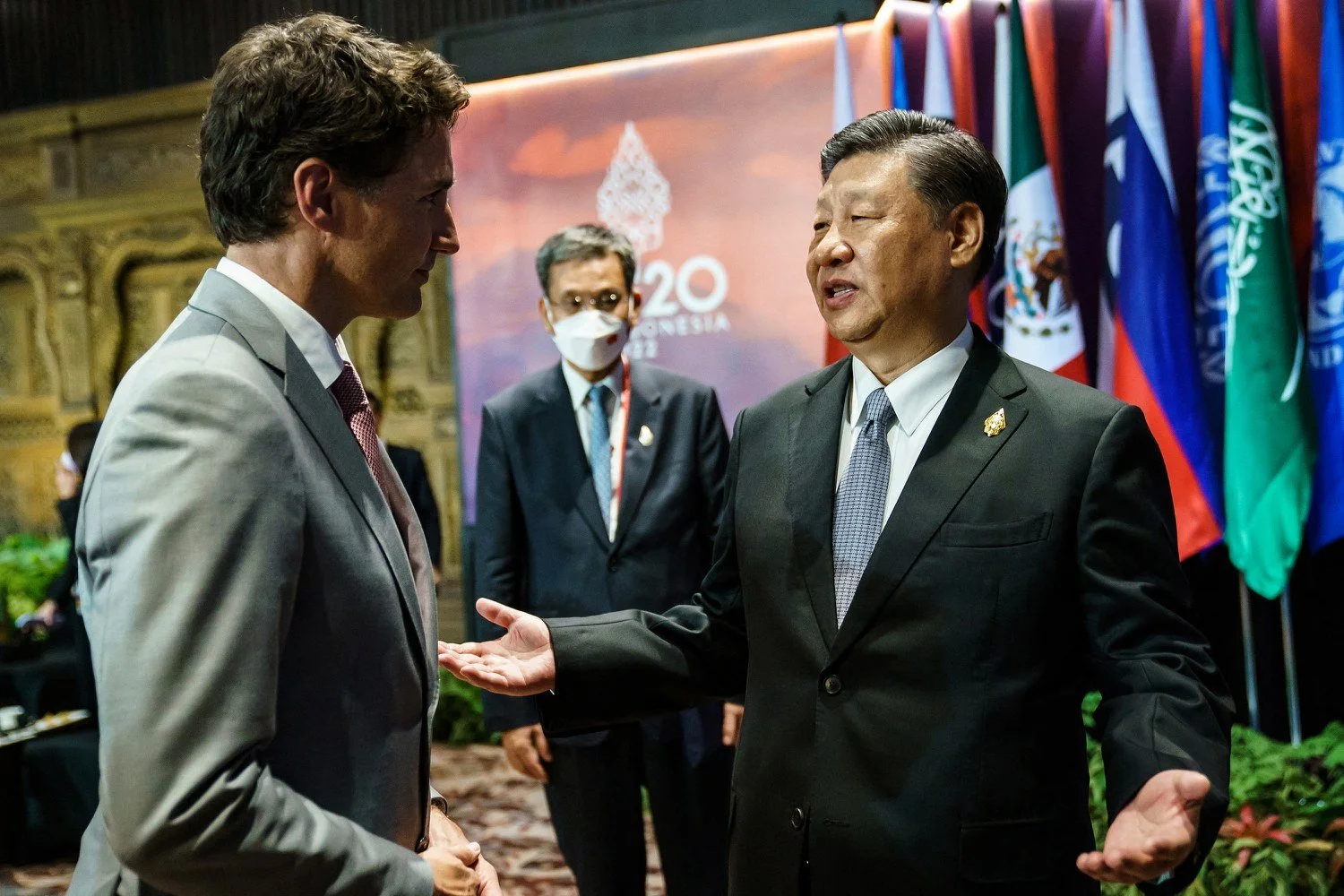

Canada has friends. Allegedly. Successive Liberal governments have allowed “friendly” China to acquire Canadian debt during a period of accelerated buying in the past decade. Meanwhile, China still owes Canada $371 million in loans it incurred decades ago, and it is not expected to repay them in full until 2045.

But recently it’s been revealed that “friendly” China has also been actively interfering in Canada’s elections. It placed spies in Canada’s top-secret biolabs in Winnipeg. It is buying up farmland in PEI and other Canadian provinces.

That has left Canada’s PM, the one who said he admired China’s ability to get things done outside democracy, stammering and obfuscating. He knows that in his current predicament he can’t afford to rile the Chinese, who blithely let Canadians die of Covid-19, a virus they spread to the world.

Already, Canada pays C$46 B a year to service its debt, more than Ottawa expects to spend on childcare benefits ($31.2 billion) and almost as much as the cost of the Canada Health Transfer ($49.4 billion). Hard to believe Canada's GDP per capita was actually higher than the US. Now, there is a $30.5k USD gap.

Should China decide to push the go button and pull back its bond paper in Canada, the result, says this executive, will be seismic. To rescue a credit-choked economy interest rates could jump back as high as the 18 percent rates of the 1980s. To say nothing of boosting personal tax rates. In case you’re part of the Denial Squad, here’s the take governments exact at the moment. Think they can take more?

NL – 54.8%

NS – 54%

ON – 53.53%

BC – 53.50%

QC – 53.31%

NB – 52.50%

PEI- 51.37%

MB – 50.4%

AB – 48%

YT – 48%

SK – 47.5%

NT – 47.05%

Not good. Canadians who think the warning signs will give them time to adjust are badly mistaken. Paraphrasing the words of Mike Campbell, the long debt descent will happen “suddenly”. Within 48 hours of China (or any other Canadian bondholder) employing the poison pill much of Canadians’ savings will be wiped out. The real estate market— which is the default savings account for millions— will implode.

You won’t hear any this from finance minister Chrystia Freeland who claims her debt-financed spending (based on international comparisons) shows Canada with the lowest level of debt in the G7. But the Fraser Institute points out, “By using net debt as a share of the economy (GDP), Canada ranks 11th lowest of 29 countries and lowest amongst the G7. By using gross debt as a share of the economy, Canada falls to 25th of 29 countries and 4th in the G7”.

If you don’t like statistics you can always just pop down to the grocery store to check out how $4.99 blueberries cost $7.99 now. The debt crisis should lead the newscasts each night. It will when reality strikes suddenly. But for now, Trudeau’s purchased media are more interested in Pierre Poilievre fear stories and TikTok videos of cats.

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada's top television sports broadcaster, he’s a regular contributor to Sirius XM Canada Talks Ch. 167. His new book Deal With It: The Trades That Stunned The NHL And Changed hockey is now available on Amazon. Inexact Science: The Six Most Compelling Draft Years In NHL History, his previous book with his son Evan, was voted the seventh-best professional hockey book of all time by bookauthority.org . His 2004 book Money Players was voted sixth best on the same list, and is available via brucedowbigginbooks.ca.